Securing a comfortable retirement isn’t as easy as it sounds – 60% of UK savers have given up hope of retiring at a reasonable age, recent research has found, because they feel they need more time to put money aside for their pensions.

In their quarterly Consumer Savings and Debt Data report, personal pension provider, True Potential Investor, revealed 28% of respondents said they were planning to work for longer to secure a bigger pension pot. This figure rose to 34% in the 25-44 age group.

Some people have chosen different methods to grow their pension pots. 25% of respondents said they would downsize their property to free up more cash and 23% said they would save more. 16% will rely on inheritance, while 13% said they’d consider taking a rental income on their property.

Whilst some people are keen to secure a comfortable pension pot for life in retirement, 36% of those surveyed said they would simply survive on less income than they would like. Figures show that £23,000 is the annual income that people believe they will need for a comfortable retirement. However, in reality, the average UK pension saver is on track to receive just £6,000 a year once retired.

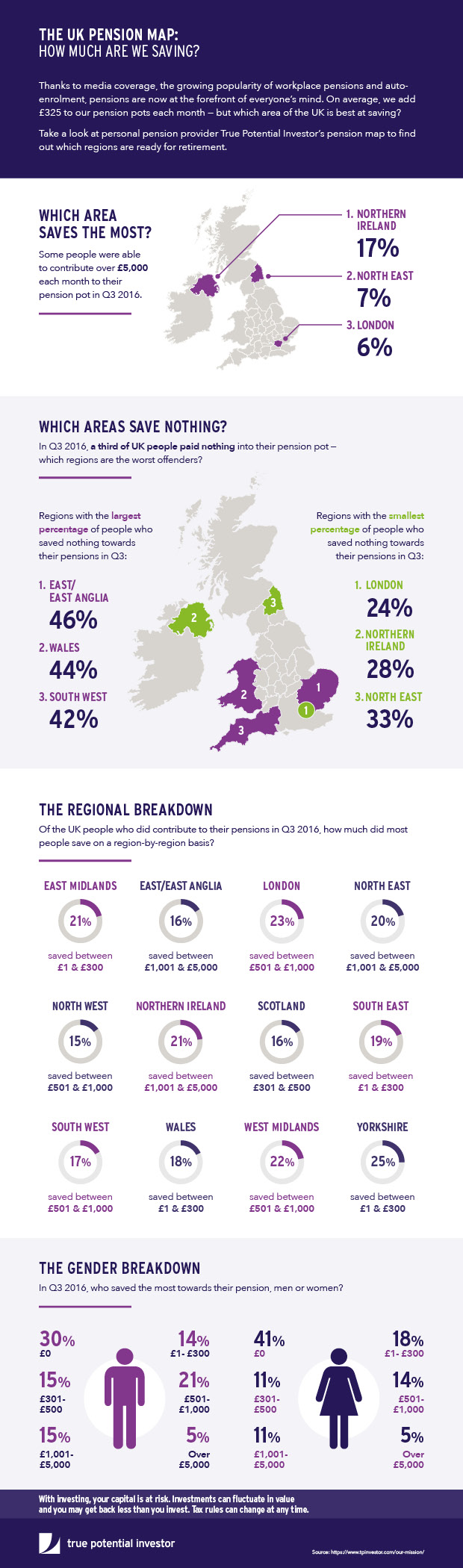

The above figures reveal how uneasy the UK feels about the pension savings gap. However, figures from the Q3 2016 report show that savings are on the up. In Q3, the number of people saving nothing towards their pension fell to 35%, down from 39% in Q2. There was a notable shift in the 24-34 age bracket too, dropping to 19% from 26% in the previous quarter.

Taking the right action early can help ensure a healthy pension pot for retirement – it’s never too early to consider contributing to your pension pot.

But is it too late to start saving? If a 27-year-old invested £3.50 a day into a growth fund, they could build a pension pot worth over £310,000 by the time they retire. Along with state pension entitlements, this could return a £20,000+ annual retirement income.

Clearly, resigning ourselves to working longer and surviving on less isn’t the only option.